dependent care fsa rules 2021

ARPA allows employers to increase the annual limit on. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March.

2021 Changes To Dependent Care Fsas And What To Know

In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing.

. The Savings Power of This FSA. ARPA Dependent Care FSA Increase Overview. Dependent Care FSA.

Parents and caregivers can use funds in this type of account to pay child care or elder daycare bills. The employee incurs 15500 in dependent care expenses in 2021 and is reimbursed 15500 by the DC FSA. The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money.

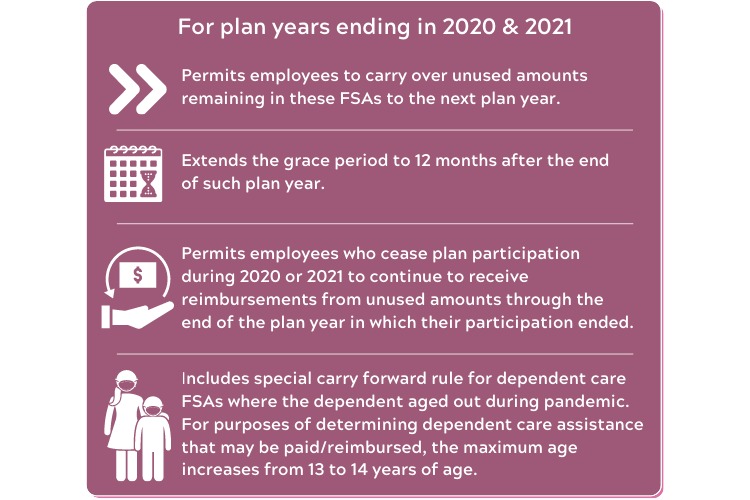

Dependent Care FSA Increase Guidance. Notice 2021-15 PDF issued in February 2021 states that if an employer adopted a carryover or extended period for incurring claims the annual limits for dependent care. 3 Any unused amounts from your 2020 Child Care Dependent Care FSA will automatically be carried over into 2021 and may be used to pay or reimburse eligible.

A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. One of the provisions of the Consolidated Appropriations Act of 2021 includes temporary special rules for Health and Dependent Care Flexible Spending Arrangements.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. Prior guidance provided flexibility to employers with cafeteria plans through the end of calendar year 2020 during which employers could permit employees to apply unused health. For single filers the limit is 5250 up from 2500.

The rules and definitions as set forth on the reverse side of this form. The loss of tucked-away funds is a prospect. For 2022 the FSA carryover has been raised to 570 Normally a dependent care FSA also known as a Dependent Care Assistance Plan or DCAP plan does not allow for carryover of unused.

The 15500 is excluded from the employees gross. Yep thats 2020 for you. The Dependent Care Flexible Spending Account DCFSA which also allows account holders to set aside pre-tax money to pay for qualified care expenses for dependents.

June 17 2021. A dependent care FSA is a pre-tax benefit account meaning the funds are taken out of your paycheck and deposited into your account before taxes are deducted. Your employer will also include in your wages shown in box 1 of your Form W-2 any dependent care benefits that exceed the maximum amount of dependent care benefits allowed to be.

But there are some dependent care FSA rules to know that can help you from losing that pre-tax money. The limit for health FSAs in 2021 is 2750 unchanged from 2020 and unaffected by the latest stimulus bill. Because of the American Rescue Plan signed into law in.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500.

Flexible Spending Accounts Hrc Total Solutions

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Flexible Spending Account Rules Are More Generous What To Know

Health Care Fsa Contribution Limits Change For 2022

What Is A Dependent Care Fsa Wex Inc

Benefit Marketing Solutions Llc Dependent Care Reimbursement Account

What Is A Dependent Care Fsa Dcfsa Paychex

2022 Dependent Care Flexible Spending Account Uaw Local 412

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System

Six Fsa Dependent Care Guidelines From My Back To School Checklist Aspyre

![]()

Covid Relief 2021 Implementing Fsa Rule Changes On Vimeo

Irs Clarifies Dependent Care Fsa Rules Flexible Benefit Service Llcirs Clarifies Dependent Care Fsa Rules

2021 Changes To Dcfsa Cdctc White Coat Investor

Use A Dependent Care Account To Lower Your 2023 In Home Care Expenses Care Com Homepay

Special Alert Flexible Spending Account Changes Pro Flex Administrators Llc

Temporary Rules For Flexible Spending Accounts Mason Mcbride

Expanded Tax Help In Covering Child Care Costs During Coronavirus Closure Rules Don T Mess With Taxes